Table of Contents

Bitcoin vs. Litecoin in 2025: Digital Gold vs. Digital Silver

Bitcoin and Litecoin are two of the oldest and most well-known cryptocurrencies, often mentioned in the same breath. While they share a common origin and similar foundational technology, they have evolved to serve very different purposes in the digital economy.

This guide breaks down their key differences in 2025, helping you understand why Bitcoin is considered “digital gold” and Litecoin “digital silver“.

At a Glance: A Comparative Snapshot Bitcoin vs. Litecoin

Here is a quick comparison of the core technical and economic differences between the two networks:

| Feature | Bitcoin (BTC) | Litecoin (LTC) |

| Primary Purpose | Store of value: “Digital Gold. | Efficient medium of exchange: “Digital Silver. |

| Launch Year | 2009 | 2011 |

| Creator | Satoshi Nakamoto (pseudonymous) | Charlie Lee (former Google engineer) |

| Block Generation Time | ~10 minutes | ~2.5 minutes |

| Transaction Speed | ~7 transactions per second | ~56 transactions per second |

| Mining Algorithm | SHA-256 | Scrypt |

| Max Supply | 21 million coins | 84 million coins |

| Network Fees | Highly variable; can be high during congestion. | Consistently low, often just a few cents. |

| Halving Events | Every ~4 years; last one in May 2024. | Every ~4 years; last one in August 2023. |

Philosophy and Vision: Two Different Roads

The most critical difference lies in their intended purpose, which dictates their technical design.

- Bitcoin (BTC): The Digital Gold Standard

Bitcoin was created as a decentralized, censorship-resistant alternative to traditional money. Over time, its primary narrative has solidified as a long-term store of value. Like gold, it is valued for its scarcity (only 21 million will ever exist), robust security, and global recognition. This makes it a favored asset for investors, institutions, and those seeking a hedge against inflation. - Litecoin (LTC): The Digital Silver for Payments

Litecoin was conceived by Charlie Lee as a complementary asset to Bitcoin—a “lighter version” designed for everyday transactions. Its focus is on being a fast, low-cost medium of exchange. The faster block times and larger total supply make it more practical for smaller, routine payments, such as buying goods or sending money across borders.

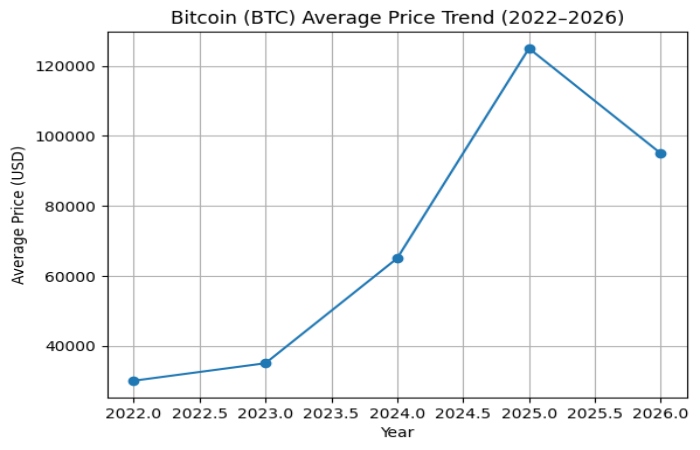

Bitcoin(BTC) average price trend (2022-2026)

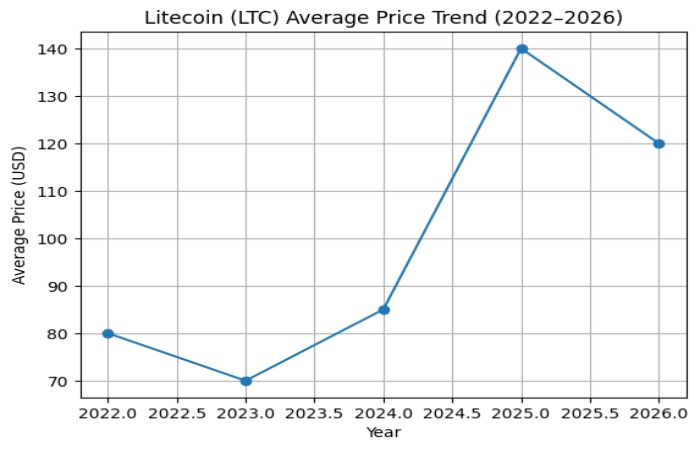

Litecoin (LTC)average price trend (2022-2026)

Geographic Adoption & Exchange Activity

Global Adoption Ranking (General Crypto)

According to Chainalysis 2025 Global Crypto Adoption Index, countries leading in overall crypto adoption (covering BTC and other assets) are:

-

India

-

United States

-

Pakistan

-

Vietnam

-

Brazil

with other countries like Nigeria, Indonesia, and Ukraine also ranking high. These rankings reflect both retail and institutional activity.

Bitcoin Adoption Highlights

-

Countries in Asia, Latin America, and Africa are showing strong momentum in grassroots Bitcoin usage and peer-to-peer trading.

-

North America and Europe lead in institutional and merchant adoption.

Litecoin Geographic Share (2025 Payments via CoinGate)

Litecoin is actively used in payments, with notable regional distribution:

-

United States – ~23.8% of LTC orders

-

Germany – ~8%

-

Nigeria – ~7.1%

-

United Kingdom – ~5.8%

-

Netherlands – ~5%

-

France – ~3.7%

-

Poland – ~2.9%

This shows Litecoin’s global payment footprint, especially in Western and African markets.

Bitcoin vs. Litecoin: Geographic Adoption & Exchange Availability

| Country | Bitcoin Adoption Level | Litecoin Usage Level | Major Exchanges Supporting BTC & LTC |

|---|---|---|---|

| India | Very High | Medium | Binance, WazirX, CoinDCX |

| United States | Very High | High | Coinbase, Kraken, Binance.US |

| Pakistan | High | Medium | Binance, OKX |

| Vietnam | High | Low | Binance, Remitano |

| Brazil | High | Medium | Binance, Mercado Bitcoin |

| Nigeria | Medium | High | Binance, KuCoin |

| Germany | High | High | Binance, Bitstamp |

| United Kingdom | High | Medium | Binance, Coinbase |

Interpretation

-

Bitcoin dominates globally as an investment and store of value.

-

Litecoin sees stronger payment usage in countries such as Nigeria, Germany, and the USA.

-

Emerging markets rely heavily on Binance-based ecosystems for both BTC and LTC trading.

Market Position, Adoption, and Security

- Market Standing: Bitcoin is the undisputed leader, often commanding over 50% of the total cryptocurrency market capitalization—a metric known as “Bitcoin dominance” . Litecoin maintains a strong position despite a significantly smaller market cap, typically ranking among the top 20 cryptocurrencies.

- Adoption: Bitcoin has seen massive institutional adoption, including spot Bitcoin ETFs, which integrate it into traditional finance. Litecoin is seeing increased adoption as a payment method and is popular with payment processors like BitPay.

- Security: Bitcoin’s network is secured by the world’s largest computational power (hash rate), making it incredibly resilient to attacks. Litecoin’s hash rate is lower but is still considered very secure, bolstered by its long operational history and the merged mining incentive with Dogecoin .

Bitcoin vs. Litecoin Exchange Availability by Region

Asia

-

BTC: Universally listed, high liquidity

-

LTC: Listed on major exchanges, moderate volume

-

Popular Exchanges: Binance, OKX, WazirX

North America

-

BTC: Spot, futures, ETFs available

-

LTC: Spot & derivatives trading

-

Popular Exchanges: Coinbase, Kraken, Binance.US

Europe

-

BTC: Institutional adoption, regulated platforms

-

LTC: Popular for payments

-

Popular Exchanges: Bitstamp, Binance, Coinbase

Africa

-

BTC: Store of value & remittances

-

LTC: Strong payment usage

-

Popular Exchanges: Binance, KuCoin, P2P platforms

Research

-

Bitcoin leads global crypto exchange volume and institutional trust.

-

Litecoin ranks among the top payment cryptocurrencies worldwide.

-

BTC is preferred for long-term holding & swing trading.

-

LTC is favored for fast trades, low fees, and beginner practice.

-

Geographic adoption patterns directly affect liquidity and volatility.

Conclusion: Which Is Better?

Bitcoin remains the dominant cryptocurrency for store of value, institutional adoption, and macro asset diversification.

Litecoin uniquely excels in low-cost daily payments and transactional use but lacks Bitcoin’s market gravitational pull.

Investment Considerations:

BTC’s structural scarcity and institutional tailwinds contrast with LTC’s niche utility focus. Investors seeking long-term “reserve asset” exposure may favor BTC, while those interested in payment usage and technical experimentation may consider LTC.

Disclaimer

Cryptocurrency adoption levels and exchange availability may vary due to regulatory changes. This content is for educational and research purposes only and should not be considered financial advice.

Also read: Partnership With Influencers: A Strategic Growth Guide for Brands